Almost everyone has a financial goal in mind. It can be traveling, freeing themselves from debt, preparing for a new baby, saving for a down payment on a house, purchasing a new vehicle, the latest iPhone, or a pair of Christian Louboutins that they’ve been coveting for awhile; planning for their retirement, saving for their child’s higher education, creating a fund for a rainy day, or all of the above.

There are some people that may feel compelled that they have to set a large amount of money aside and/or set up a certain time-frame in order to obtain their financial goal(s). This often leads to falling short since this usually causes other financial fiascoes in our lives. The best and most surefire way to avoid these type of financial situations is creating a budget plan, tracking expenses or talking to a financial adviser. These steps are small, yet can lead to significant changes and a better, brighter financial future!

Small Changes = Big Results

⦾ My mother taught me the value of a dollar when I was a child. That is why I firmly believe that it is never too early to educate your children the value of a dollar, as it can help learn how to budget and avoid financial pitfalls. Understanding the importance of the value of a dollar can help you save hundreds or even thousands of dollars in the long run!

It’s not that a universal secret that I have a love for traveling. A pair of Christian Louboutins may be splurge-worthy to someone one else, but I have a different perspective since I know that a pair of shoes isn’t meant to last forever. For me, traveling creates memories that can be cherished for a lifetime. I personally want to travel until the wheels of my suitcase fall off! One of my favorite ways of stretching out my money for my passion is taking “advantage” of hotel rewards programs.

⦾ One of the first small steps is identifying your financial goals. You can’t achieve your goals if you don’t have an understanding of what your goals are.

⦾ Determine your most valuable asset, whether it is your home, business, or your ability to work. Take your income into consideration and it affects your overall well-being and financial future.

⦾ It always helps to have a lending ear when it comes to our finances, even more importantly, if that lending ear is knowledgeable about finances. That lending ear can be a parent, sibling, friend, neighbor, or even a financial professional. There are several different types of financial professionals.

⦾ If you’re caught in a whirlwind of the hustle and bustle of life, finances may be the least thing that crosses your mind. To obtain or even surpass your financial goal(s), getting organized is key. You can get organized with your finances by creating a budget plan and tracking your daily expenses, which you can easily do with a budget tracker that can help your financial goals into results.

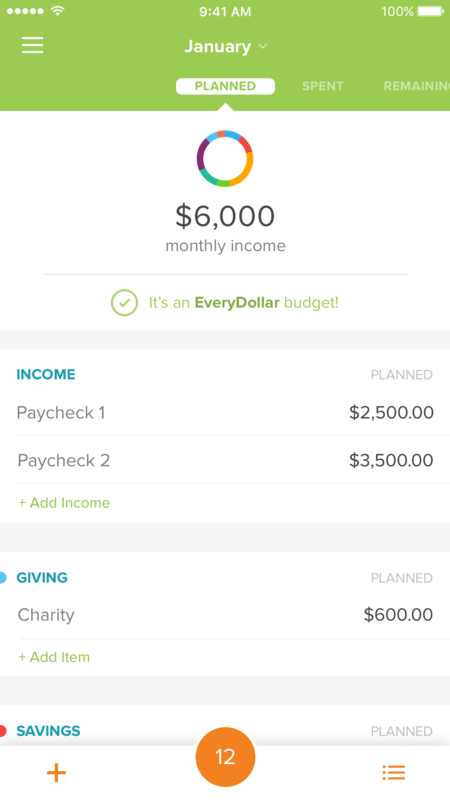

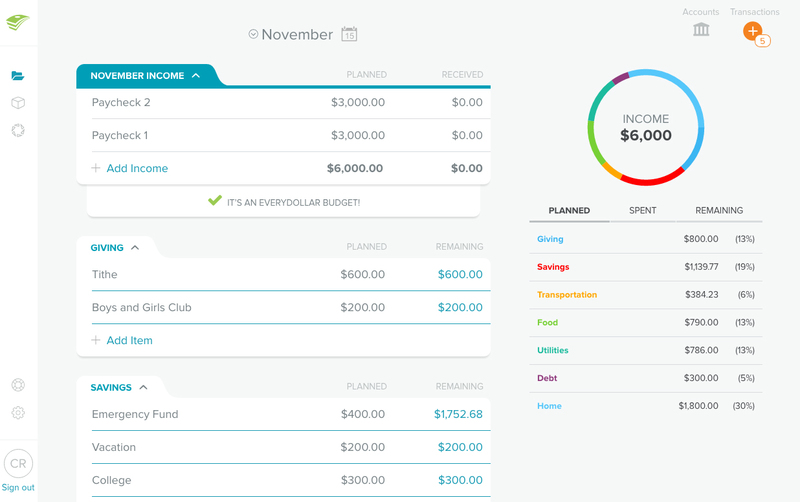

My favorite budget tracker is EveryDollar. What exactly is EveryDollar and how can your financial goals turn into results by using it? Well, it’s a free app (available on iOS, Android, and online) that simplifies budgeting. You can create your first budget within 10 minutes! You can also manage your finances and track your spending anywhere and anytime, whether it’s from your phone or computer. Long gone are the days of pen, paper, and complicated spreadsheets! With an EveryDollar budget, you can live more and worry less.

Please note that these are screenshots are just an example on how you can use the app. I may be open to sharing different aspects of my life, but my income is not one of them!

While the EverDollar app is completely free, there is also a premium version of it: EveryDollar Plus. With EveryDollar Plus, you can connect to your bank for speedier expense tracking, created unlimited budgets, receive call-back support and coaching calls, and view account balances within EveryDollar.

Add Comment